vermont sales tax on alcohol

Local option tax does not apply to the sale or rental of motor vehicles which are subject to the motor vehicle purchase and use tax. Exemptions to the Vermont sales tax will vary by state.

Governments Dip Deeper Into Alcohol Tax Well

The sales tax rate is 6.

. Local Option Sales Tax. In other words there is no use tax due to. Vermonts excise tax on Spirits is ranked 15 out of the 50 states.

See our website at taxvermontgov for information related to the necessary forms and for due dates. Contain one-half of 1 or. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states.

Control of the sale. Alcoholic beverages subject to meals and rooms tax are exempt from sales and use tax. The Middlebury Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Middlebury local sales taxesThe local sales tax consists of a 100 city sales tax.

For those who sell beer cider RTD spirits beverages or wine to stores or restaurants. Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale.

1800 per 31-gallon barrel or 005 per 12-oz can. 15th highest liquor tax. Sales up to 500000.

45 rows Sales and Use Tax. Vermont does not expect you to pay Vermont Sales Tax in addition to what you have already paid at a higher rate of sales tax in another state. Preliminary reports are created 75 days after.

The tax on alcohol depends on the type and alcohol content of the beverage. Alcoholic Beverage Sales Tax. The Manchester Vermont sales tax rate of 7 applies in the zip code 05254.

Additionally wholesalers must pay a tax on spirits and fortified wines as follows. Are suitable for human consumption and. W-4VT Employees Withholding Allowance Certificate.

PA-1 Special Power of Attorney. Such as gasoline or alcohol usually imposed on the. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US.

Sales and Use Tax. For beverages sold by. Vermont Sales Tax is charged on the retail sales of tangible.

Remember that zip code boundaries. Vermont Use Tax is imposed on the buyer. Constitution repealed the Volstead Act Prohibition.

Vermonts sin taxes cover alcohol and cigarettes. Beer over 6 percent alcohol by volume. Federal excise tax rates on beer wine and liquor are as follows.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. The Department of Taxes publishes Meals and Rooms Tax and Sales and Use Tax data by month quarter calendar year and fiscal year.

974113 with the exception of soft drinks. IN-111 Vermont Income Tax Return. There are approximately 845 people living in the Manchester area.

107 - 340 per gallon or 021 - 067 per 750ml. Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that. For producers of beer cider wine RTD spirits beverages and spirits.

Mrt 441 Pdf Fill Out Sign Online Dochub

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

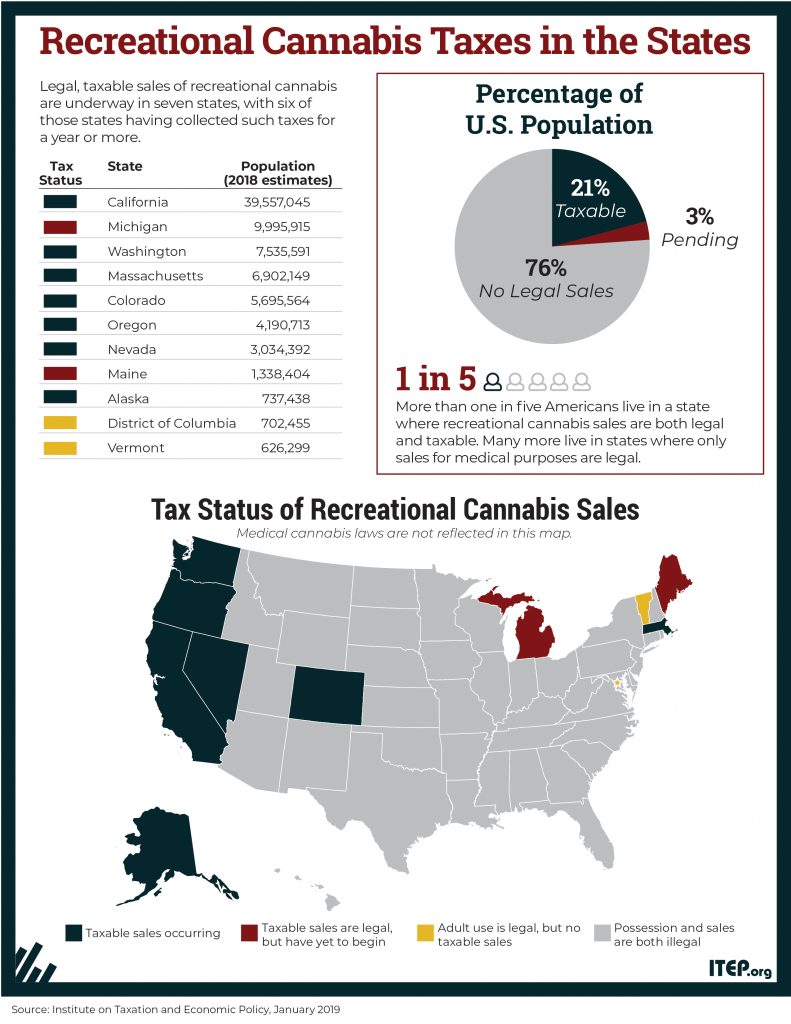

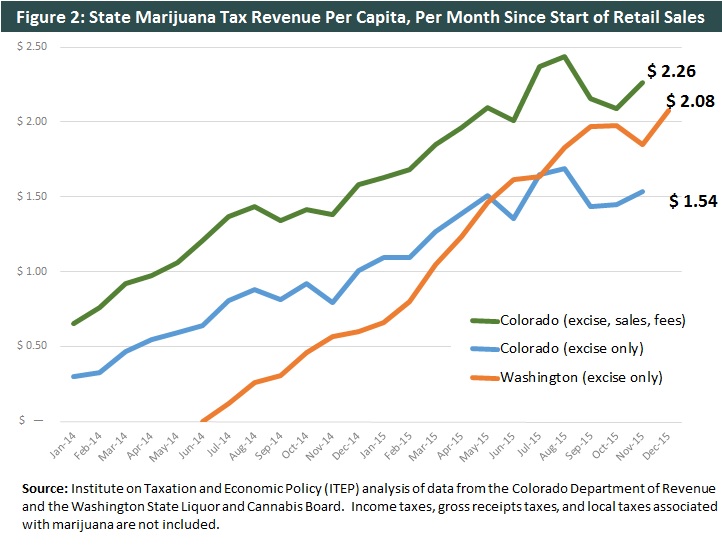

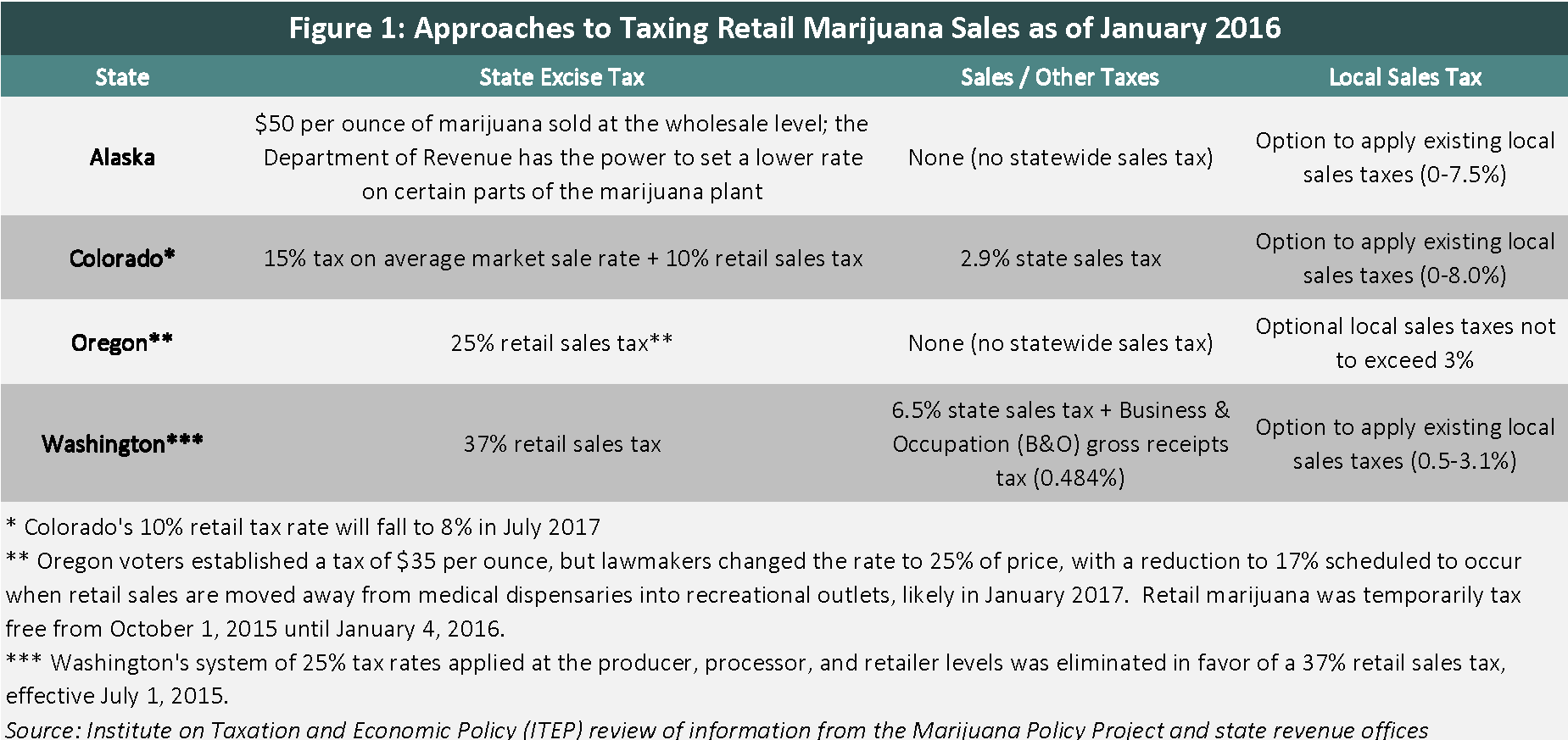

Testimony Before The Vermont Senate Committee On Finance Tax Policy Issues With Legalized Retail Marijuana Itep

A New Wave Of Vermont Distillers Pushes Legislators To Modernize Liquor Laws Business Seven Days Vermont S Independent Voice

Vermont Legislature Expands Market For Ready To Drink Spirits Beverages Food Drink Features Seven Days Vermont S Independent Voice

Vermont Income Tax Vt State Tax Calculator Community Tax

Sales And Use Tax Department Of Taxes

New State Laws On Sexual Consent Health Care And Alcohol Sales Take Effect July 1 Vtdigger

Vermont Liquor Handouts Hurt Taxpayers And The Local Beer Economy Beer Institute

Testimony Before The Vermont Senate Committee On Finance Tax Policy Issues With Legalized Retail Marijuana Itep

Vermont Named 1 Least Tax Friendly State For Retirees Vermont Business Magazine

Beer Map How High Are Beer Taxes In Your State State Beer Map

By The Numbers Virginia Ranks 3rd Highest On Alcohol Taxes Virginia Thecentersquare Com

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Vintage Advertising Print Alcohol Walker S Deluxe Snow Ski Bob Vermont Slope 61 Ebay

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground